The global financial system has changed dramatically in the last decade, particularly when it comes to tax compliance and transparency. One of the most significant developments in this area is the Common Reporting Standard (CRS), an initiative launched by the Organisation for Economic Co-operation and Development (OECD).

CRS is designed to combat tax evasion and money laundering by enabling the automatic exchange of financial information between countries. For many individuals and businesses, this means that maintaining offshore bank accounts or investment portfolios without proper reporting is no longer a viable option.

In this comprehensive guide, we will explore everything you need to know about CRS: how it works, what information is shared, who is affected, and what steps you should take to remain compliant.

What is CRS and Why Was It Introduced?

The Common Reporting Standard (CRS) is an international framework for the automatic exchange of financial account information between tax authorities. It was introduced by the OECD in 2014 and has since been adopted by more than 100 jurisdictions worldwide.

Before CRS, countries relied primarily on Tax Information Exchange Agreements (TIEAs). These agreements allowed tax authorities in one country to request financial information about their residents from another country. However, these exchanges were not automatic and only occurred when there was a specific request, often during a tax investigation.

CRS changed this process entirely by making the exchange of financial data automatic and annual. This means that financial institutions in participating countries are required to collect and share account information with their local tax authority, which then forwards it to the tax authority of the account holder’s country of tax residence.

How Does CRS Work in Practice?

To understand CRS, you need to know who the key players are and how the process unfolds:

Step 1: Financial Institutions Collect Data

Banks, brokerage firms, and certain insurance companies are required to identify the tax residency of their account holders. This is done during the account opening process through self-certification forms and, in some cases, additional documentation.

Step 2: Annual Reporting to Local Authorities

Once a year, these institutions compile the required account details and submit them to the local tax authority in the jurisdiction where the account is held.

Step 3: Exchange Between Countries

The local authority then shares the information with the tax authority of the country where the account holder is a tax resident. This process occurs automatically and does not require any special request from either side.

Who is Affected by CRS?

CRS applies to individuals and entities that maintain financial accounts in jurisdictions that are part of the CRS network. It affects:

- Personal account holders: Residents of CRS-participating countries who hold accounts abroad.

- Corporate account holders: Businesses incorporated in one country but holding accounts in another.

- Trusts and partnerships: These entities must also disclose their controlling persons.

It is worth noting that CRS does not currently apply to U.S. tax residents in the same way because the United States has its own reporting framework, FATCA (Foreign Account Tax Compliance Act).

What Information Does CRS Report?

CRS reporting is detailed but not as invasive as some people believe. Here is a breakdown of what is shared:

For Individual Accounts

- Account holder’s name

- Address

- Tax Identification Number (TIN)

- Date and place of birth

- Country or countries of tax residence

- Account number and type

- Balance as of the reporting date (usually December 31)

- Total interest paid during the reporting period

For Investment or Brokerage Accounts

In addition to the above, the following details are reported:

- Dividends paid into the account

- Interest income

- Certain capital gains

For Business Accounts

Both the company’s tax residency details and the tax residency details of its controlling persons (beneficial owners) are reported.

What is NOT Reported?

Contrary to popular belief, CRS does not report your entire transaction history. It focuses on balances, interest income, and dividends, not every purchase or transfer.

The Global Impact of CRS

The introduction of CRS has significantly reduced the ability to hide undeclared assets in foreign jurisdictions. While some individuals have attempted to bypass CRS through complex structures, these strategies are becoming increasingly risky and legally questionable.

CRS has also created new compliance obligations for financial institutions. Banks and other reporting entities now spend significant resources on customer due diligence, record-keeping, and reporting systems.

CRS vs. FATCA: What’s the Difference?

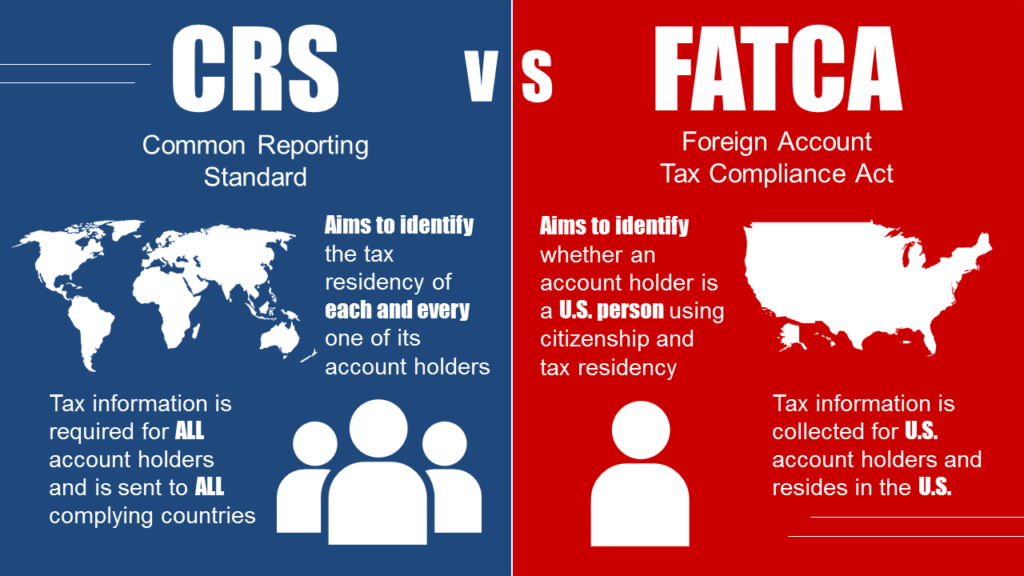

Many people confuse CRS with FATCA, but the two are distinct:

- FATCA: A U.S.-specific law that targets U.S. taxpayers with foreign accounts.

- CRS: A global initiative adopted by over 100 countries, focusing on automatic exchange of information among them.

Unlike FATCA, which is unilateral and enforces compliance through penalties, CRS operates on a multilateral framework where each participating jurisdiction commits to sharing information.

Common Myths About CRS

Myth 1: CRS Reports Every Transaction

False. CRS reports balances and certain income details but not every single transaction.

Myth 2: CRS Applies Only to Large Accounts

Incorrect. CRS does not have a minimum threshold for personal accounts, although some institutions may apply internal thresholds for operational reasons.

Myth 3: You Can Avoid CRS by Opening an Account in a Non-Participating Country

While this was possible in the early days, the network of CRS jurisdictions is so extensive today that very few places remain outside its scope.

What Does This Mean for You?

If you are a global entrepreneur, investor, or someone who has offshore accounts, CRS impacts your financial privacy and tax compliance strategy. Here is what you should consider:

- Ensure your tax residency status is clear and properly documented.

- Report all foreign accounts to your home tax authority where required by law.

- Seek advice from a qualified tax professional to structure your assets in a compliant way.

Failure to comply with CRS requirements can result in severe penalties in your home country, including fines and criminal liability in extreme cases.

Practical Tips for Staying Compliant Under CRS

- Update Your Information: Make sure your tax residency details with your bank or broker are accurate.

- Understand Local Laws: CRS does not override local tax laws. You are still required to comply with the regulations of your home country.

- Avoid Misrepresentation: Providing false information to a financial institution is not only unethical but also illegal.

- Plan Ahead: If you are moving abroad or changing tax residency, inform your bank and update your records to avoid compliance issues.

Key Takeaways

- CRS is an automatic exchange of financial information between countries to prevent tax evasion.

- Over 100 countries participate, making offshore secrecy almost impossible for tax purposes.

- Only essential details like account balances, interest, and dividends are reported—not your entire transaction history.

- Compliance is critical to avoid penalties and reputational risks.

Conclusion

The Common Reporting Standard is a game-changer for international tax compliance. While it may feel like an invasion of privacy to some, it represents a global effort to create a fairer and more transparent financial system. For individuals and businesses with cross-border accounts, the best strategy is simple: stay informed, stay compliant, and seek professional guidance when needed.

If you are unsure about how CRS affects your specific situation or need help with tax planning, reach out to a trusted tax advisor who understands international compliance requirements.